Portfolio

as of March 31, 2025, and based on fair value unless otherwise noted

224

Portfolio companies

19.8%

Top 10 concentration3

$14.1bn

Portfolio Fair Value

10.8%

Weighted average annual yield on accruing debt investments4

63.3%

Senior secured investments1

$120mm / 5.7x

Median portfolio company EBITDA & leverage2

2.1%

Non-accrual rate at FV

23

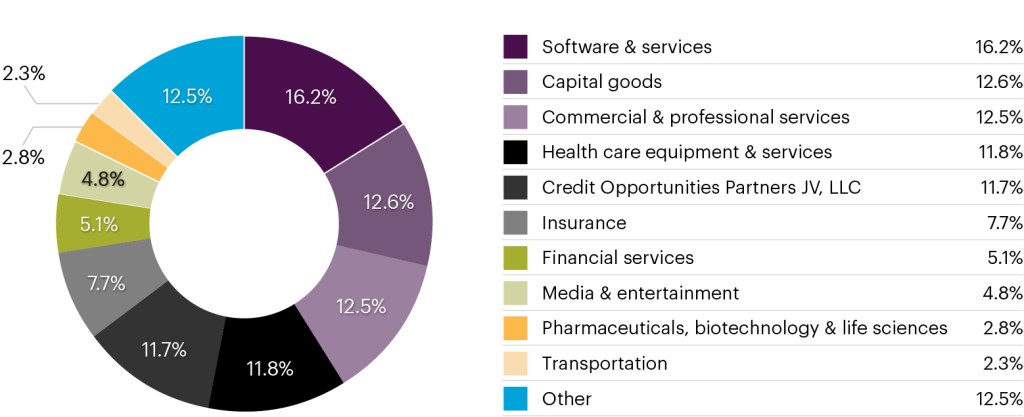

Industries

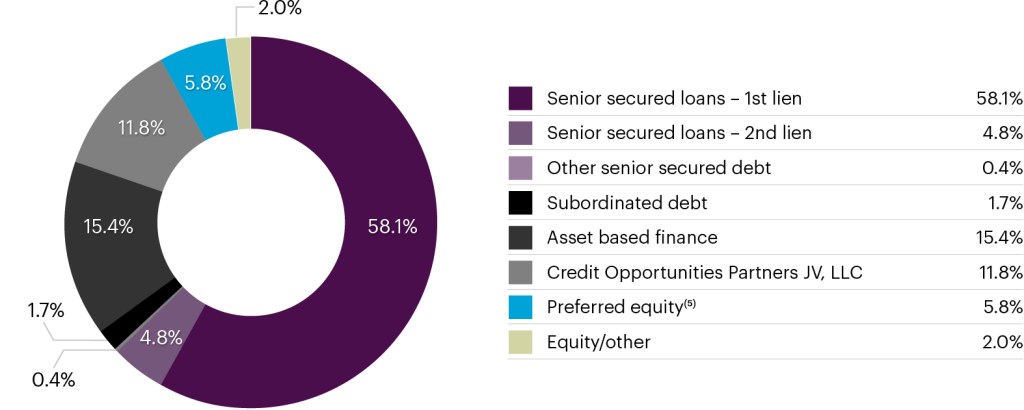

Security exposure

Sector exposure across top 10 industries

View important footnotes + disclosures

Note: Does not look through to FSK’s portfolio companies held solely in COPJV unless otherwise stated.

- Looking through to the investments in COPJV, senior secured investments total 72.6% as of March 31, 2025.

- Based on underlying Direct Origination corporate investments using most recently reported financial information and may include pro forma adjustments. Certain Asset Based Finance, Equity/Other and portfolio companies with negative or de minimis EBITDA are excluded.

- Figure excludes the impact of FSK’s investment in COPJV.

- Excludes the impact of the Merger. See FSK’s Quarterly Report on Form 10-Q for additional information on the calculation of weighted average annual yield on accruing debt investments. On a GAAP basis, FSK’s weighted average annual yield on accruing debt investments was 11.0% as of March 31, 2025.

- Included within Equity/Other in FSK’s Quarterly and Annual Reports on Form 10-Q and 10-K, respectively.